- Professional Construction Software Solutions

- 480-705-4241

Bluebeam Tips: Notes with Icons

March 10, 2015

Bluebeam Tip: Adding a Responsibility Column with a Choice to your Worklist

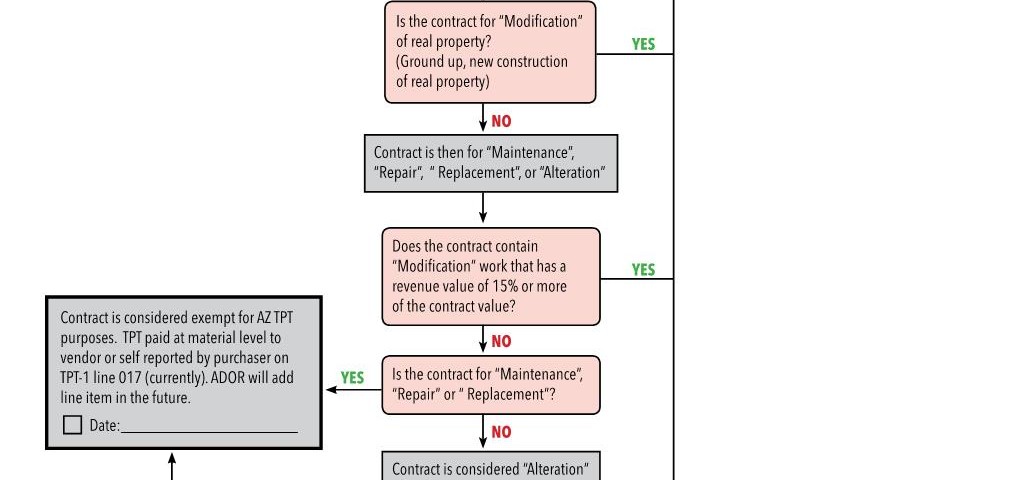

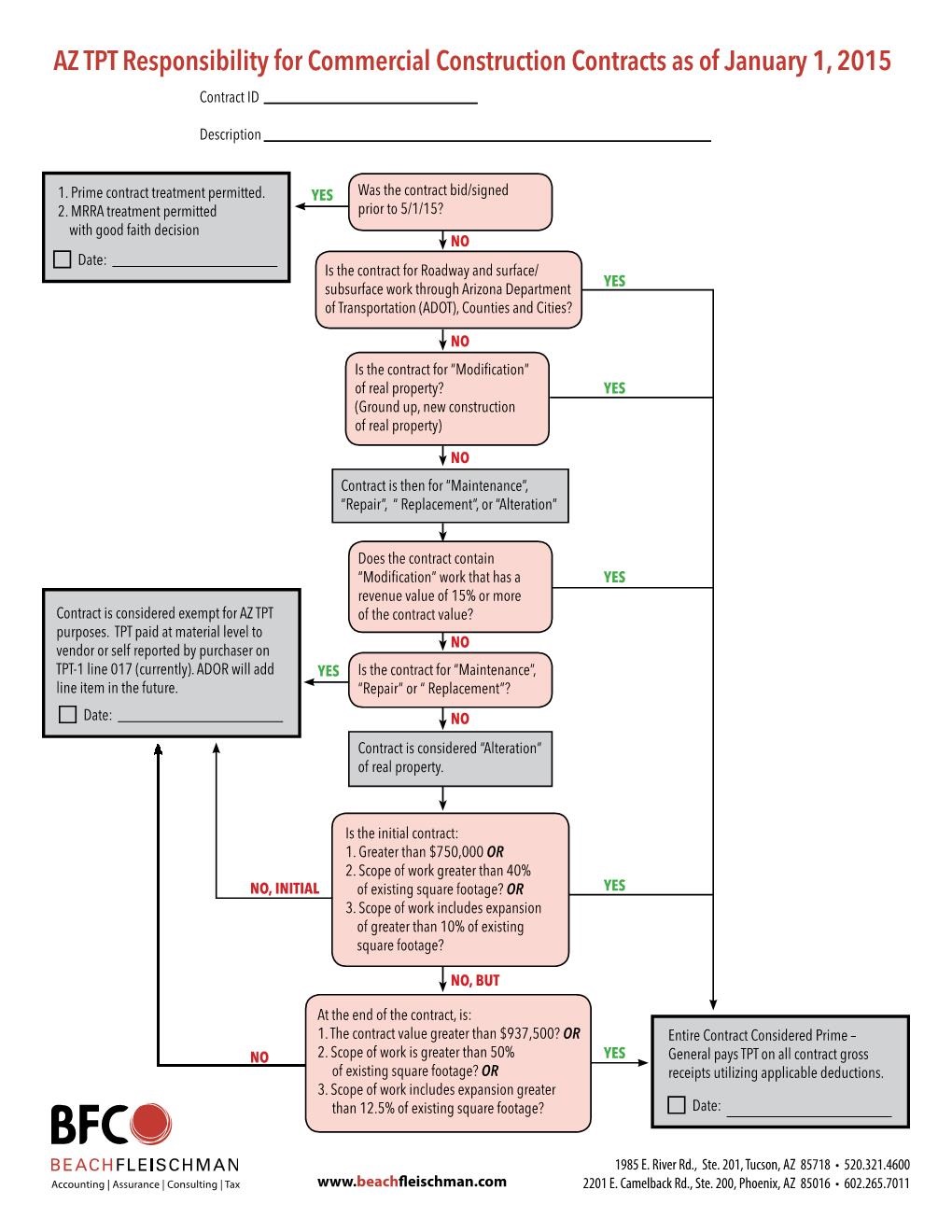

March 26, 2015If you’re in construction and perform work in Arizona, the first few months of 2015 have been confusing when it comes to sales tax (know as Transaction Privilege Tax). The recent changes signed into law a few weeks ago by our governor is supposed to ease the burdens on reporting and clarify the rules for the contracting community. After attending a few presentations on the subject by the Construction Financial Management Association (CFMA) and the National Association of Women in Construction (NAWIC) it is abundantly clear that the construction industry needs help in understanding what is required.

Many professional organizations are sponsoring lunch and learns, all day courses and everything in between. It was nice to stumble onto a resource handout that will ease some of the burden. As a tech geek, flow charts and decision trees clarify not only the best decision, but how you arrived at your choice. The flow charts below will guide you to the correct choice whether your construction project should be treated as a Prime Contract, Maintenance, Repair, Replacement or Alteration (MRRA), or your Contract is Exempt and sales tax is collected at material purchase or tracked by the purchaser and self reported. Thanks go out to BeachFleischman PC for creating these flow charts for both commercial and residential construction contracts.

File these with each project as a supporting document (in case of an audit from the Arizona Department of Revenue) and circle the Yes/No answers you used. Don’t forget to fill in the date in whichever grey box you end up in. To request a copy of these flow charts, please Email Me Your Contact Info

For advice on any tax interpretations, talk with your Certified Public Accountant or get connected with the CFMA to find a CPA that focuses on construction.

2 Comments

Isn’t decision blocks should be represented in diamonds shapes in the above flowcharts. here is an flowchart guide that I found with details.

Shalin, yes, thanks for the flowchart tip. I’ll pass it on to the author or the flowchart.